FINANCIAL

PLANS #2

Last week, I talked about personal

financial plans and introduced the idea of church financial plans.

For a personal financial plan, it

should:

- ·

Prioritize

savings for the future

- ·

Focus

on reducing existing debt

- ·

Divide

the rest of your income into your expense categories, like housing, food,

clothing, transportation.

- · Do

all of this, keeping God in mind.

The

keeping God in mind concept is good, reducing debt is good, prioritizing

savings is also good; but I think there’s a different way to approach a church’s

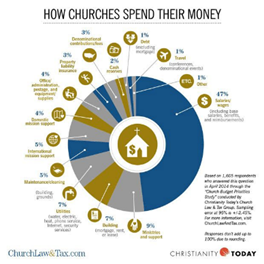

financial plan. Church Law & Tax did a study about how churches spend their

money. How does this compare to your church?

Start

with the amount of income you “know” you’re going to receive during the upcoming

year. You will, of course, have to make some assumptions: pledges and “known”

unpledged giving, rental income, interest income, etc., may vary in reality,

but you probably have a pretty good idea and you have to start somewhere. Once you’ve

done this, start a list. Start with the amount of income at the top.

Then,

create a list of the “fixed” expenses. You know which ones I mean, the ones you

have to pay, no matter way—utilities, mortgages, real estate taxes,

retirement and health insurance. Subtract the sub-total of that from your

income number. Write that number down.

Then

create a second list of the “semi-variable” expenses. These are expenses that

may seem fixed, but can be changed. That may be ministry shares (although these

should be fixed). It may be payroll. Please keep in mind that paying employees

is a fixed cost, but changing who is employed and for what positions can be

changed. It may not happen today or tomorrow, or even a month or two from now,

but in about 12 months or so, those amounts might be changed. Then subtract

that sub-total from your remaining income number. Write that number down.

The

expenses that are left are “variable” and don’t have to be paid. These

are most likely your mission and ministry amounts.

That

all sounds good, but I want to point out where this will point out issues that

you need to look at when making your financial plan.

If

there is no income left after the fixed or even the semi-variable

expenses, there is an immediate need to work on a plan. The way you’re set up

prevents you from doing any ministry that you are called to do.

Reducing

employees, including clergy, might be a short-term solution, but unless a plan

is put in place to “right the ship”, this may start a repeating cycle.

Mission

and ministry, for accounting purposes, may be variable costs, but mission and ministry

is what we are called, as churches, to do and be. If we’re not able to do that,

but are only paying to keep doors open and lights on—what does that say to us

as a church?

This

is all an accounting procedure, but it should be able to help you figure out

what your financial reality says about your future as a church!

______________________________________________________________________

Please feel free to contact me at (315)

427-3668 or susanranous@unyumc.org

if you’d like help with your church’s financial reality and planning for the

future.

No comments:

Post a Comment