GIVING

COMMUNICATION

CHANGING OUR FOCUS

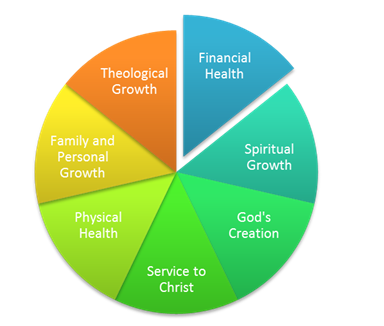

Over the last few weeks of summer,

we focused on customizing the approach to discipleship and stewardship based on

life stages, spiritual maturity and financial health.

Lots of ideas, but we struggle in

talking about money and giving and generosity in the church, don’t we? When someone

approaches us complaining that “all we do is talk about money”, we promise that

we only do it during the fall when we “have to.”

Well, one of the problems with that

is we’ve placed the focus squarely on the money, which shouldn’t even be the

real point of the whole stewardship/discipleship story! I know Jesus talked about money more than

anything else in his stories and parables, but it wasn’t because money was the

point, but because he knew how much importance we would place on it.

What if we changed our focus? I’ve

said it before, and I want to say it again, it’s the need of the giver to give,

not the need of the church to get that we need to focus on.

· Too many of our stewardship campaigns (and I’m as guilty of this as anyone else) is focused on what we need to pay for in the upcoming year, i.e. payroll, utilities, paper, technology, etc.

· AND too many of our discipleship plans and work focus on getting more people on the pews—increase those numbers!

What if instead:

·

For Stewardship:

o

We

made some changes in how we focus on what it “costs” to do church?

o

What

is it we need to focus on in our particular context?

o

Looked

at our church’s mission?

·

For Discipleship:

o

We

looked at our church’s mission and who we have and who we don’t have in our disciples?

o

What

if we looked at our folks’ spiritual gifts and where they are in their own

discipleship?

It seems like a lot of

work, and it probably is, but the benefits would be huge! For the next couple

of weeks, I will spend time on how some of this could work and things that we

could be doing to change our stewardship focus and our discipleship focus.

If you wish more information on anything

you’ve been reading about, please feel free to contact me at (315) 427-3668 or sranousacctg@twcny.rr.com. I’d be happy to help.